Irs Legally Blind Definition

This person isn t considered legally blind but they can have difficulty in.

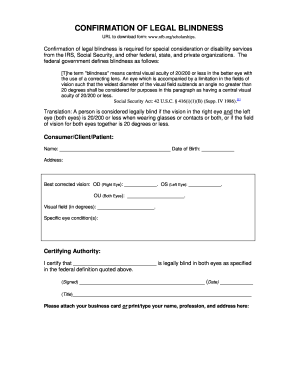

Irs legally blind definition. Legally blind is the definition of blindness used by the u s. Tax return for seniors pdf. Individual income tax return pdf or form 1040 sr u s.

In the u s the standard definition of legal blindness is based on central visual acuity what s in front of you and field of vision what s above below and to the sides. Legally blind means you re essentially sightless in the eyes of the law if eyeglasses or contact lenses cannot correct your vision beyond specific standards. How do we define who s legally blind.

If you or your spouse were age 65 or older or blind at the end of the year be sure to claim an additional standard deduction by checking the appropriate boxes for age or blindness on form 1040 u s. Blind filers may not use form 1040ez to obtain a higher deduction. For the definition of blindness refer to publication 501 dependents standard deduction and filing information.

Designation as legally blind must be made on irs tax form 1040 on line 39a or 1040a on line 23a. Being legally blind affects your vision but it doesn t have to stop you from leading a fulfilling life. The deduction amount will be subtracted from the filer s annual gross income agi which will reduce the amount of money on which taxes must be paid.

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)

/ap675784005308-5bfc32dfc9e77c0026b65b37.jpg)