Legally Blind Tax Deduction

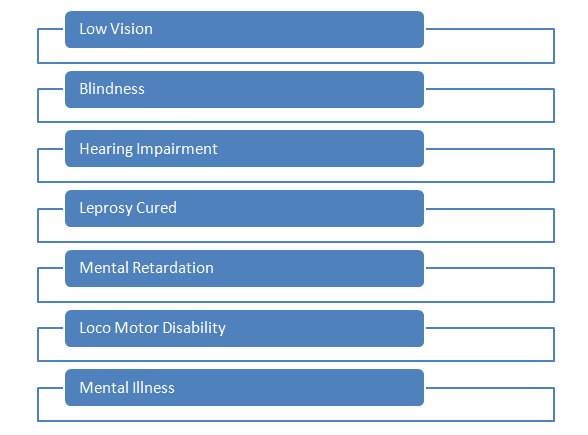

A taxpayer who qualifies for the additional standard deduction amount accorded to blind persons.

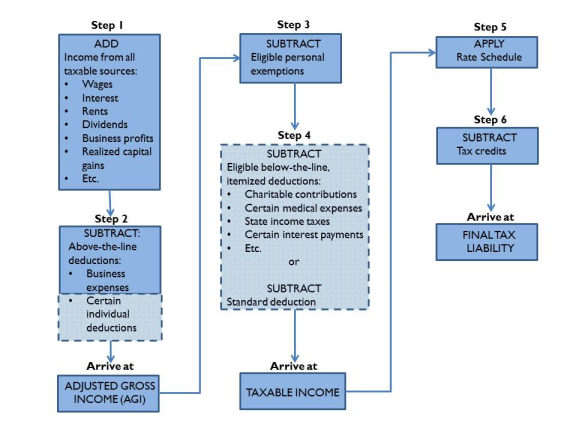

Legally blind tax deduction. Work expenses if your blindness affects your employment you may be able to get a tax deduction for business expenses that help you do your job. Had gross income refer to publication 525 taxable and nontaxable information to see if you qualify for any special credits or deductions. A lesser known fact about the standard deduction however is it can be increased for those over age 65 or who are blind.

There is a larger standard deduction if the taxpayer and or spouse is age 65 or older or blind. Individual income tax return page 1 will indicate if there are additional amounts to include in the standard deduction. Tax return for seniors pdf.

If you re blind and over age 65 your savings increases. If you or your spouse were age 65 or older or blind at the end of the year be sure to claim an additional standard deduction by checking the appropriate boxes for age or blindness on form 1040 u s. Irs form 1040 u s.

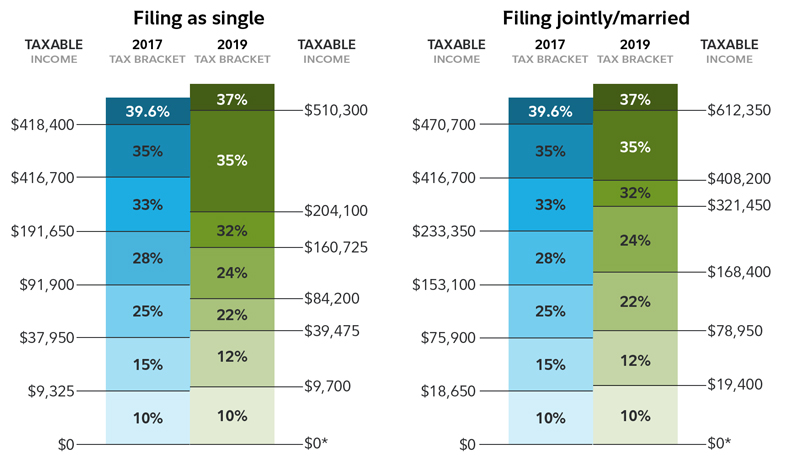

This translates into a larger tax break allowing you to subtract a bigger standard tax deduction from your adjusted gross income. Because it s a deduction it helps only those with positive income tax liability. Legally blind single taxpayers could add 1 400 to that amount for a total deduction of 7 100.

To see if you qualify for an increased standard deduction. Designation as legally blind must be made on irs tax form 1040 on line 39a or 1040a on line 23a. The standard deduction is the amount every taxpayer can deduct from their income and with the changes to the tax law more taxpayers than ever will now be taking the standard deduction.

There s no distinguishing between degrees of blindness or when someone became blind. A bigger standard tax deduction for blind taxpayers. Box 39a on the 1040 tax return form is where blind filers can claim unique deductions.

The amount of the additional standard deduction is based on your filing status. A legally blind taxpayer can deduct a variety of costs associated with a guide dog. The combined blind elderly deduction on line 39a reduced federal tax revenues by 2 billion in fiscal year 2008.

Blind filers may not use form 1040ez to obtain a higher deduction. Individual income tax return pdf or form 1040 sr u s. Are legally blind refer to publication 501 exemptions standard deduction and filing information pdf.

But helping the blind through the tax code has its drawbacks.

/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)